Reverse mortgage calculator aarp

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The providers terms conditions and policies apply.

3 Steps To Clinching The Maximum 3 895 Social Security Benefit The Motley Fool In 2022 Senior Discounts Social Security The Motley Fool

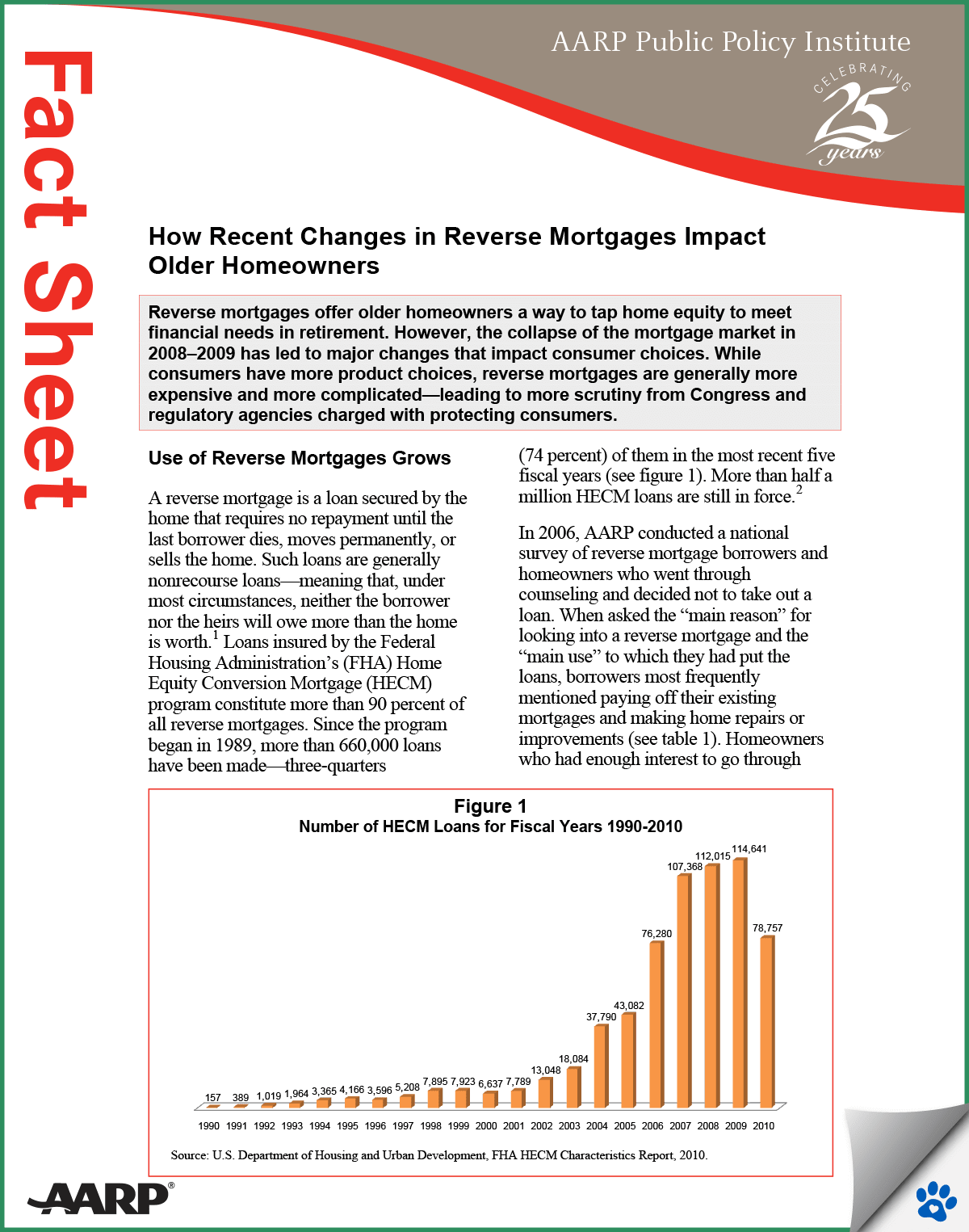

Bank of America announced in February 2011 that it would exit the reverse mortgage business and Wells Fargo made a similar announcement later that year.

. Or ongoing care in a nursing home assisted living residence or other facility. Your home as a piggy bank. Community services like adult day care and transportation.

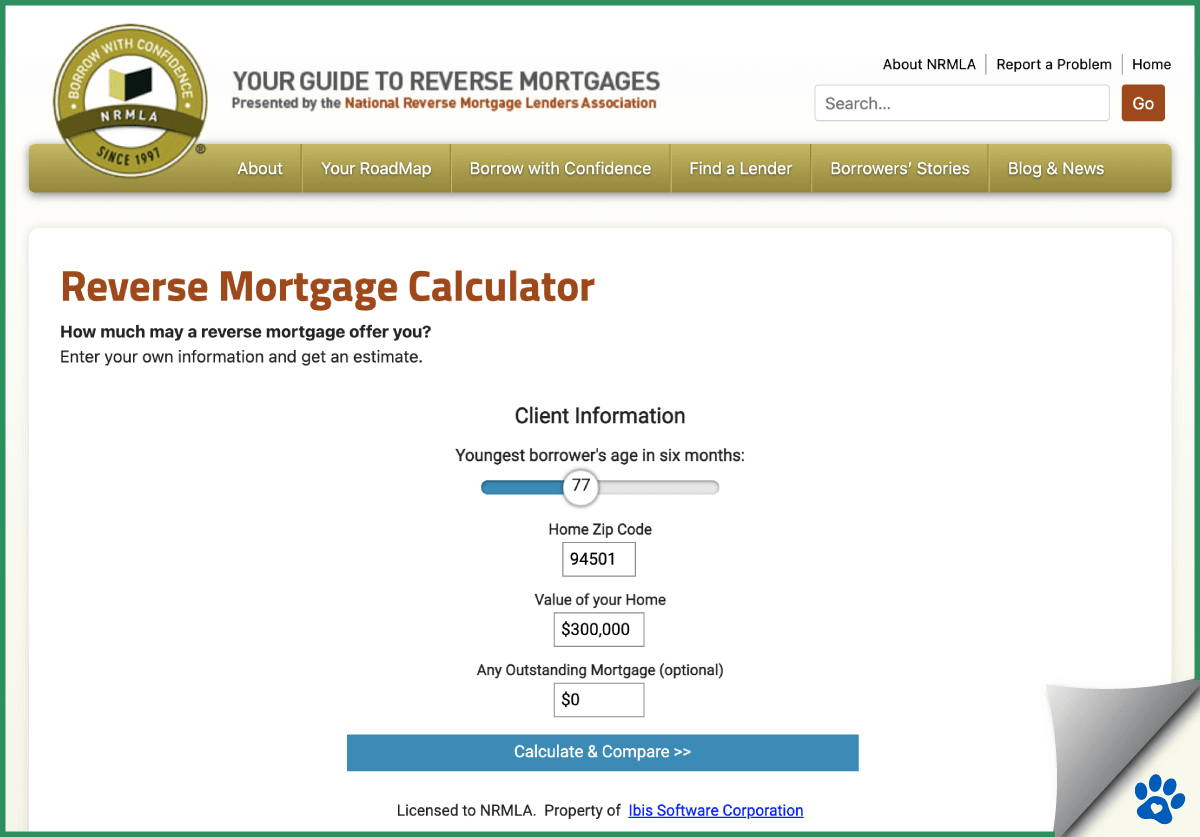

AARPs involvement in the reverse mortgage industry is to make sure HUD is responsible in its underwriting guidelines and looking after the interest of. The loan is secured on the borrowers property through a process. A calculator that uses slider bars to graphically show the principal vs.

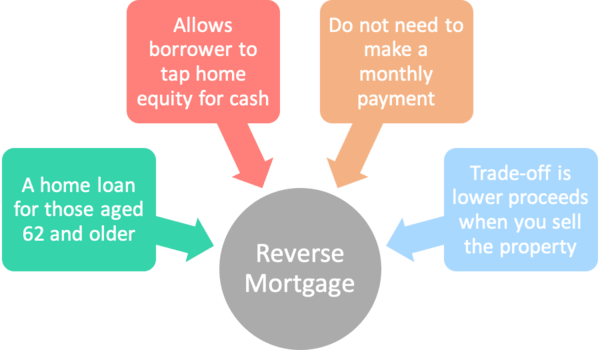

These commercials do a good job of introducing the reverse mortgage product. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. A reverse mortgage is a loan based on the paid-up current value or equity in your home.

Chase Home Value Calculator Westside Property contents multiple listing service applying current mortgage loan rates current mortgage loan valuation feature. It takes this data and combines it with. However many people dont want to leave their longtime homes especially if that means leaving nearby family and friends.

A home equity loan a home equity line of credit and a reverse mortgage. AARP is a senior organization that first lobbied Congress and successfully brought forward a reverse mortgage program on a national level and signed into law by Ronald Reagan in 1988. That means you may need help at home with basic daily activities such as bathing dressing and eating.

Use this calculator to determine the total cost in todays dollars of various mortgage alternatives taking into account your opportunity cost of money. Request your free information kit here or call us at 800 224-0103. Even if the lender goes out of business the loan proceeds are still.

In addition to its downsides there are three examples of when a reverse mortgage might be totally out of the question. Unlike a conventional mortgage your lender pays you in monthly payments through a variable line of credit or in a lump sum. AARP is the nations largest nonprofit nonpartisan organization dedicated to empowering Americans 50 and older to choose how they live as they age.

So far over 350000 people have used this tool. LifeSpan Calculator from Northwestern Mutual. This is great feedback for seeing.

However the decision to secure the loan can be complicated and confusing. You might find reverse mortgage originators that offer higher or lower margins and various credits on lender fees or closing costs. Think about the reasons you were considering getting a reverse mortgage in the first place.

Based on property value and may vary by lender. You absolutely can lose your home if you have a reverse mortgage. A home equity loan is a lump-sum loan secured by the paid-up portion of a home the amount left over.

Up-front mortgage insurance premium. The AAG Advantage Jumbo Reverse Mortgage is AAGs privately offered reverse mortgage intended exclusively for owners of high-value homes. This calculator uses a detailed statistical analysis of NIH-AARP data and is sometimes called the Wharton Life Expectancy Calculator.

Use AAGs Reverse Mortgage Calculator to estimate the funds available to you based on your home value equity your age and more. Reasons Why a Reverse Mortgage Might Not Work for You. Find articles on credit personal loans and debt relief from AARP.

Redfin aarp mar 16 As a broker Redfin uses the most accurate data from the multiple listing service MLS to calculate your propertys. Interest breakdown over the period of the mortgage. Typical Reverse Mortgage Closing Costs.

Your budget is too tight you cant afford your day-to-day bills and. While this might seem strange Chase. If you are shopping for the best reverse mortgage interest rate be sure to first compare the programs payment options explained in detail below.

A reverse mortgage calculator utilizes information specific to a borrower to determine how much they can receive from a reverse mortgage. One option to pay for such services is long. Reverse mortgage borrowers can opt to receive their loan proceeds as a lump sum as a line of credit or in ongoing installments.

Someday you may need long-term care. Every time you answer one of the 14 questions on this easy to use life expectancy calculator your estimated longevity is updated. You want to move fairly soon.

Find reverse mortgage financial information tools reverse mortgage calculator and tips. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. If a reverse mortgage lender tells you You wont lose your home theyre not being straight with you.

The HUD HECM allows for an eligible non-borrowing spouse under the age of 62 that although they cannot access the reverse mortgage funds if the eligible borrower were to leave the home they can remain in the home for life by following the same reverse mortgage provisions live in the home as their primary residence pay the taxes. If you have built up a lot of equity in your primary residence maximizing your retirement portfolio may be difficult with the payout limits of government-insured reverse. NewRetirement offers a Reverse Mortgage Suitability Calculator that assesses whether or not the loan is a good fit for you.

A reverse mortgage doesnt affect your Medicare or Social Security benefits but it might affect your eligibility for Medicaid benefits. This includes the age of the youngest borrower or spouse the estimated home value the amount of existing liens if any and the zip code location of the property. AARP podcast on reverse mortgages.

You Could Lose Your Home. Daniel has 10 years of experience reporting on investments and personal finance for outlets like. Daniel Kurt is an expert on retirement planning insurance home ownership loan basics and more.

The margin used in our calculator is 175 basis points 175. Wells Fargo originated more than 16000 reverse mortgages in the prior year. Following the financial crisis however both of those banks decided to discontinue their reverse mortgage operations.

8 watch AARPs webinar Build Your Money Confidence to Get Financially Healthy. Those people have three other options none entirely satisfactory. Its a fact of life.

Reverse mortgage insurance guarantees that these loan proceeds will be disbursed to the borrower as agreed upon under the terms of the loan. Read the latest credit loans and debt news and issues including reverse mortgage credit card management and interest rates. The lender will add a margin to the index to determine the rate of interest actually being charged.

Many prospects first gravitate to a fixed rate but find the mandatory lump sum unattractive when compared to the flexibility of a line of credit option or monthly payment plans featured on variable interest rate options. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. The AAG Advantage Jumbo Reverse Mortgage.

Reverse Mortgages Who They Re For And The Pros And Cons

What Is Aarp S Role In Reverse Mortgages

Reverse Mortgage Alternatives 5 Options For Seniors Credible

Reverse Mortgage Calculator Aarp Free Online Eligibility Refinance Fha Kevin A Guttman

10 Reasons To Build A Time Machine And Go Back To The 1960s Mcdonald S Restaurant Senior Discounts Mcdonalds

Scrabble Retire And Wealth Reverse Mortgage Mortgage Loans Mortgage

Reverse Mortgage Calculator Aarp Free Online Eligibility Refinance Fha Kevin A Guttman

Reverse Mortgage Calculator Aarp Free Online Eligibility Refinance Fha Kevin A Guttman

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

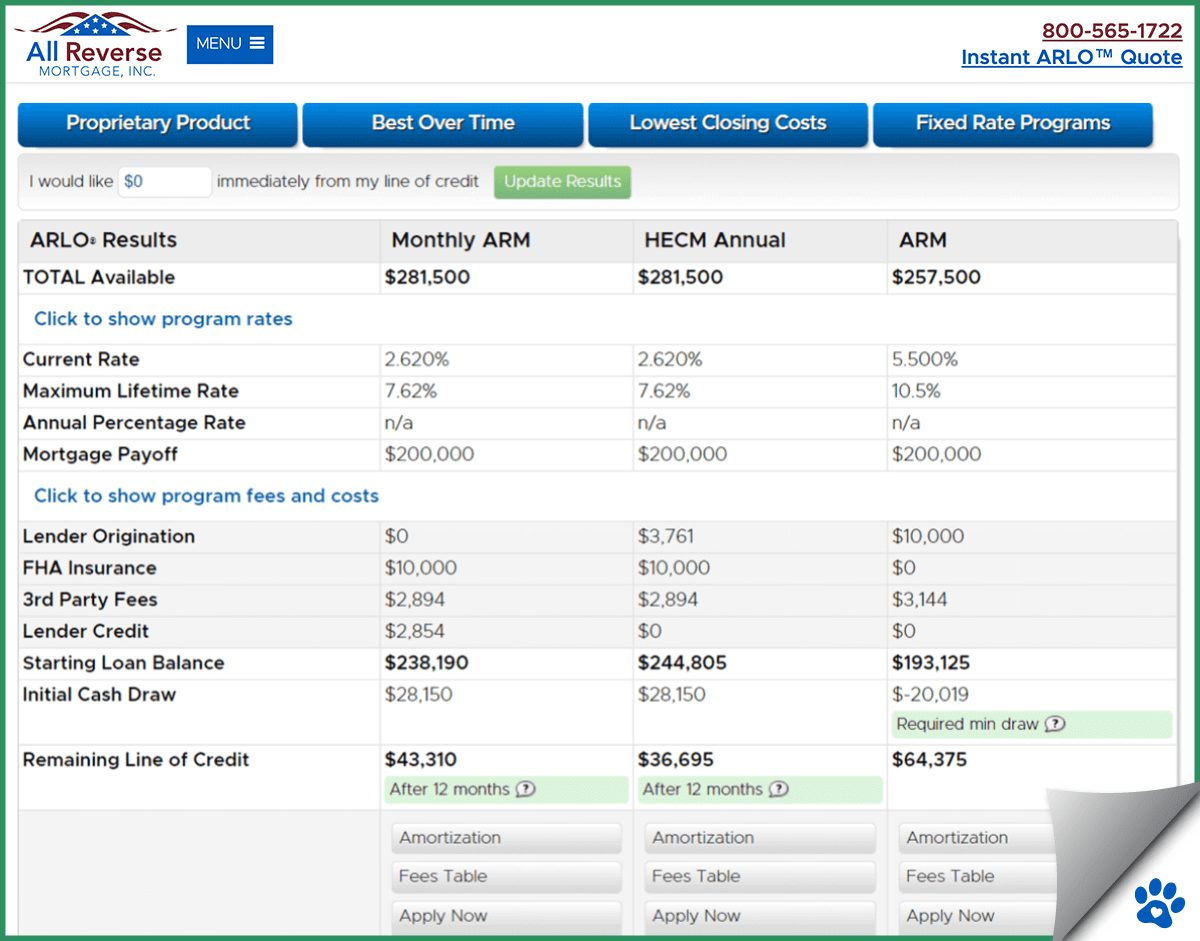

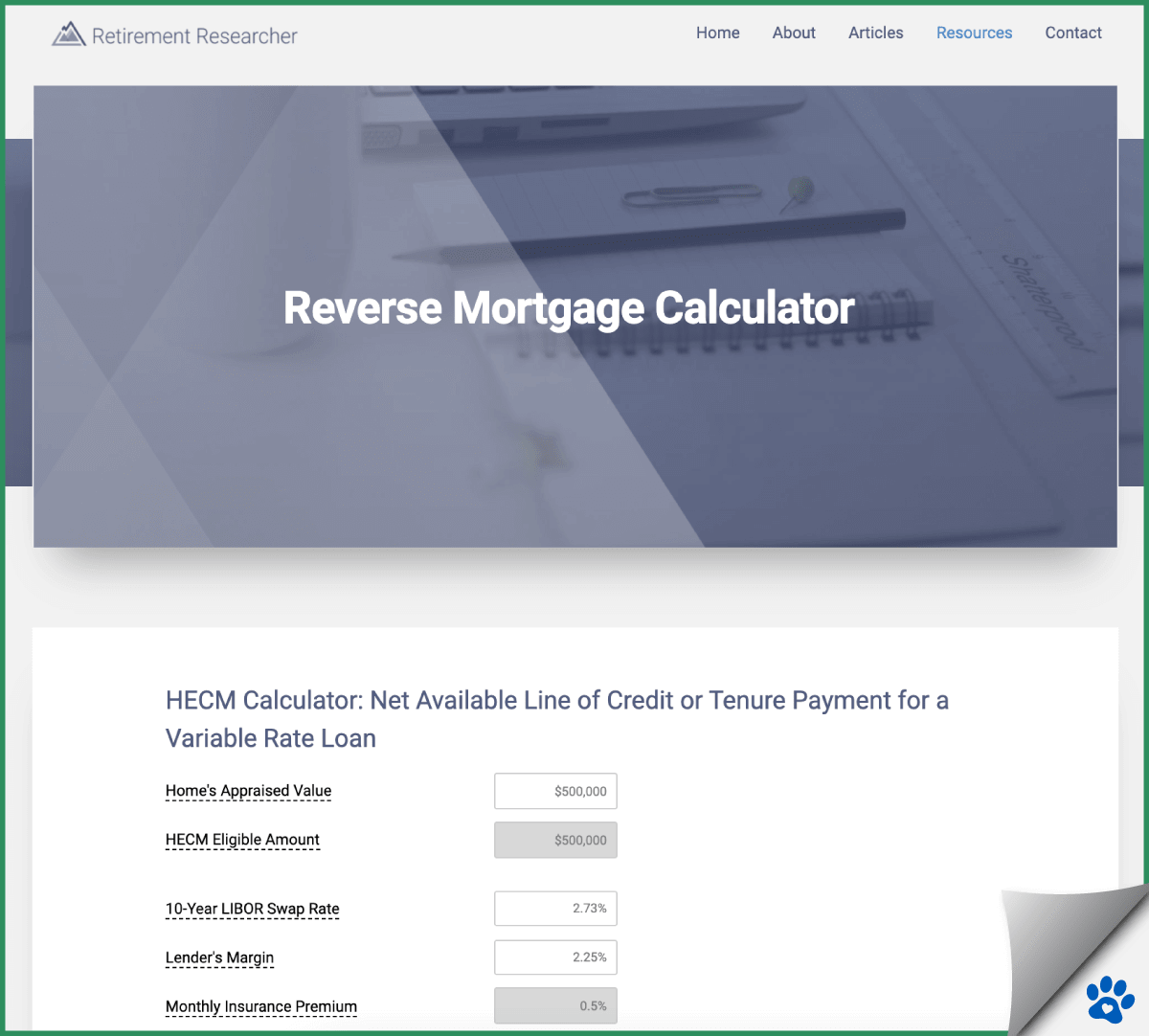

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

Reverse Mortgage Calculator Aarp Free Online Eligibility Refinance Fha Kevin A Guttman

Boston Ma Seventh Most Expensive City For Realestate Housing Homebuying Broker Massachusetts Association Of Buyer Agents Second Mortgage Refinance Mortgage Refinancing Mortgage

In The Event That You Are Searching For The Administrations Of A Trustworthy Level Roofer In Falkirk Ensure Yo Roof Repair Roofing Services Commercial Roofing

Reverse Mortgage Calculator Reverse Mortgage

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info